Have you ever lost a game of Monopoly? You probably have. So, you know that in this iconic capitalist game, you lose when you don’t have enough money to pay.

Yeah, when your cash is already running low and the roll of dice lands you on the most expensive properties, you know you’re on your way out of the game.

You can literally go bankrupt and sell off your little houses, hotels, and mortgages, to get some cash back and pay your debt. And if that’s not enough, you’re out. It’s simple enough for a game but it’s pretty much the same in real-life capitalism.

But of course, it is far from being that simple in the real world.

As you may have figured out by now, we love to talk about dead or struggling companies, which usually end up bankrupt. Out of Monopoly and back into the real world, when you see the news, especially after an unforgettable 2020, you will come across the term bankruptcy quite often.

Just in the retail sector last year, Century 21, Brooks Brothers, JCPenney, GNC, JCrew, Guitar Center and a bunch of others all filed for bankruptcy and filled the news headlines.

But, somehow, if you go to your local mall today, you may find bankrupt stores up and running, things like Aldo, still there, selling you the same cool looking shoes that don’t last very long. Even though they filed for bankruptcy.

So what gives? Is it a marketing scheme? No, definitely not. Is it a capitalist instrument to keep the economy going? Maybe something more like that.

Let’s talk about Bankruptcy.

Just like with everything, bankruptcy can have many different outcomes. Overall, you should know that it’s rather a NIGHTMARE of a process, but sometimes, not most times, but sometimes, it can save a company.

Many people may believe that when a company goes bankrupt, that's it; it's out of business. And in most cases, that's how it goes. But it turns out that it could be more like a delicate organ transplant than just a death sentence. You know, it can save a company’s life, but sometimes the patient just dies.

But first, let’s understand a bit of the situation in which a company might find itself in, to decide to go on the bankruptcy path.

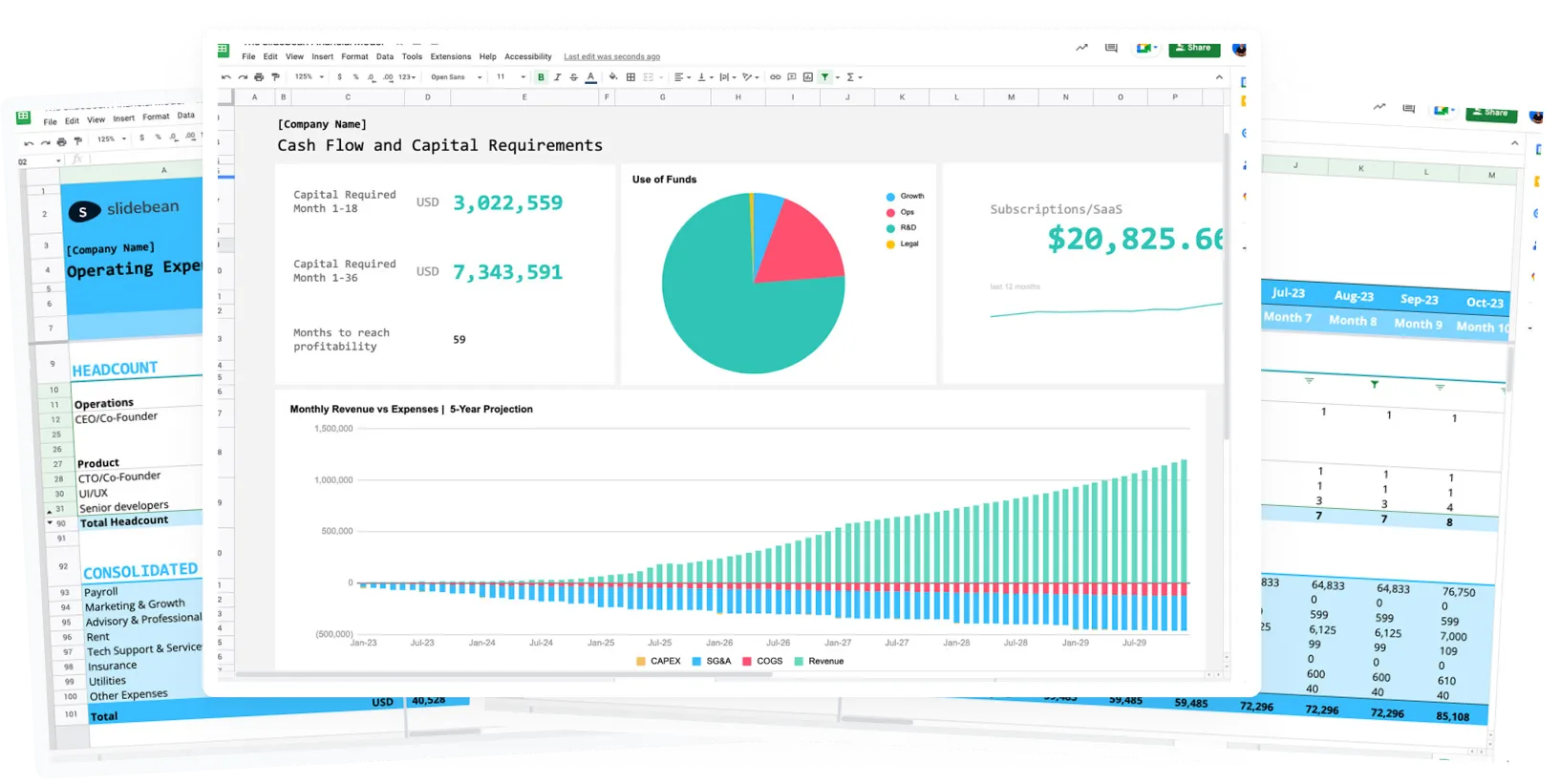

We’ll need to get a grip on a couple of terms first. Let’s imagine a company called Slidebean. It’s this awesome toolkit for startups.

This company owns a website, slidebean.com. It has a piece of software. Some cash in the bank. A bunch of Macbooks. They printed a bunch of T-Shirts to sell on Youtube, but nobody is buying them. These are all ASSETS.

However, it may have a withstanding business loan. Say it’s the middle of the month now, so it owes wages that haven’t been paid yet. Maybe they threw a crazy post-COVID party and haven’t paid for it yet. These are all LIABILITIES.

So ASSETS are Cash, Investments, Inventory, Office equipment, Machinery, Real estate, Company-owned vehicles. Intellectual Property, which in this case applies to our trademark, and our code.

On the other side, LIABILITIES represent Bank or Mortgage debt, Money owed to suppliers (accounts payable for that party we threw), Wages owed or even Taxes owed.

The combination of the ASSETS, and the LIABILITIES make up for a BALANCE SHEET. For companies that are publicly traded in the stock market, these balance sheets are public. And, as you could imagine, if the company liabilities exceed the value of its assets and profits overall, then the company is in trouble.

Since Slidebean is not going bankrupt, we’ll need a new example. There are quite many, but let’s talk about American Airlines, who had a rough year in 2020, just like many, but it has had a few bumps in its road before, particularly when it filed for bankruptcy back in 2011.

At the time, American Airlines found themselves with $24.72 Billion in assets, and $29.55 Billion in liabilities. That’s red. Only about $5B red.

So like I said, LIABILITIES might be loans, debt, and stuff they haven’t paid. Anybody who was owed money by American Airlines is considered a CREDITOR. That can be someone who gave them credit, who loaned them money, or provided a service.

In this case, American Airlines is the DEBTOR. Since they found themselves in quite a tough spot, they decided to file a Chapter 11 Bankruptcy.

Chapter 11 is a particular type of bankruptcy PROTECTION, and it is contemplated in the US Bankruptcy code. Chapter 7 is probably the other most common type of bankruptcy, and we’ll get to it in a moment.

Filing for Chapter 11 bankruptcy allows the company to restructure itself, to try and get out of the hole they’re in. It gives them around 4 to 18 months time.

If you’re curious, for a small business the process might cost up to $50,000- which I find a bit crazy considering you are going bankrupt.

And, on top of the cost of filing for Chapter 11, the restructuring process is anything but simple. Ultimately, it involves rethinking the company’s finances from the ground up, while continuing to provide jobs for its employees, pay its creditors, and produce a return for stockholders. Sounds like a lot for a business running out of money.

But, the company is not saying its kaput, it’s just saying… I might die soon, please, people I owe money to, have mercy. And this mercy part is pretty much real, and it's ultimately delivered by legal and justice authorities.

When the documents are presented, all collections activity and legal proceedings that relate to debt are immediately stopped, in order for a court to step in and manage the restructuring process.

If say, American Airlines had CREDIT on an airplane, and they haven’t paid their dues - at a point, the CREDITOR could take control of that ASSET. Bye plane. However, once under Bankruptcy protection and while it lasts, all creditors are halted from collecting debts.

This allows the company to continue operating, and so they did. Flights and reservations were honored, because the company could continue to operate, it just didn’t have enough money to pay all of its DEBT, yet.

But this is a pretty huge company, a top US Airline. It’s a business that evidently could generate revenue in the future… so this bankruptcy protection gives them time, and the protection of the law, to try and get out of a mess.

If you think about it, a company with such large and expensive assets like airplanes in this case, can be more valuable while operating and putting those assets to use, than just selling them off in a liquidation.

In the American Airlines story, one of their biggest LIABILITIES was contracts with Unions. Filing for bankruptcy legally encourages everyone at the negotiating table to… renegotiate. Why?

Because if the company does go belly up and liquidates, some of these creditors could eventually walk out completely empty handed. We’ll get to that in a sec.

So, a CREDITOR might, for example, renegotiate the terms of their credit to ensure the DEBTOR pays. They might exchange part of their debt for equity in the company. This is not the best outcome, but the other option can be very nasty and is what everyone wants to avoid.

One of the biggest concerns back then for American Airlines, was the pension fund for their employees. In the US, Pension funds are saved and paid by the company itself, not by the government. Late stage capitalism.

So the problem here was that if the company went bust, or if it just didn’t have money to pay their LIABILITIES (their pension fund being one as well), people could lose, not only their jobs, but also access to those benefits.

Apparently, the pension plans offered by American Airlines, which covered almost 130,000 workers at the moment, represented around $18.5 billion in benefits, but the company only has $8.3 billion in assets.

This Bankruptcy mode also allows them to negotiate and sell some of their ASSETS. For example, sell the rights to an airline route. Oftentimes, other companies can come in as well, to be part of the rescue operation. Quite literally, to buy them out.

That is, to purchase the entire operation at a discount, with the intention of injecting the missing capital and reorganizing the company to get it back on track.

Now, mind you, this process usually fails. Apparently only 10-15% of Chapter 11 bankruptcy filings end up with a company pushing through on the other end.

Still, this concept of Chapter 11 bankruptcy has been called an ‘American Export’. Other countries have adopted it because the essence makes sense: why break something in parts when as a whole, it could generate revenue?

However, for the 80-85% of failed Chapter 11s, the next step is a Chapter 7. Yet another chapter of the US Bankruptcy code, which, by the way, contemplates bankruptcy processes for individuals, cities, and international entities. So, yeah, everyone can go bankrupt in the US.

In any case, some of the other chapters are pretty random. If you’re curious, Chapter 9 is for cities (the city of Detroit once had to file it), 15 is for multinationals, and quite randomly 12 is for farmers and fishermen. Really.

Chapter 7 is the- “i’m dead” type of bankruptcy. People can also file for this one, you may remember some millionaires going bankrupt, Mike Tyson being one of the most iconic examples, or even Larry King, way back in the late seventies.

Chapter 7 means the debtor, company or individual, will LIQUIDATE all of its assets. And, of course, it sucks.

Back to our own example, if we had to go Chapter 7, the first step would be filing with the court, which apparently costs between $3,000 and $5,000, including lawyer fees.

At that point, the company needs to stop operations and you’ll be assigned with a TRUSTEE by the court. This person will look through all of the company ASSETS and try and sell them for cash. Simple and harsh as that.

In our first example, using Slidebean, that’ll probably be our computers, our office stuff, our furniture, our code, our brands, our Youtube channel. Those are all company ASSETS.

Now at this point, it’s clear that if the company filed for bankruptcy it means it doesn’t have money to pay all of its LIABILITIES - So there are rules that come into play here, and what you want to be looking at is WHO GETS PAID FIRST.

The remainder of cash is first used to pay the TRUSTEE himself, who makes a percentage of the money it manages to raise. The company is essentially paying for the bankruptcy process, so that comes first.

Next in line are CREDITORS who had secured assets, so CREDITORS who gave loans based on physical pieces of property. These are debts like the mortgage on company buildings or leases on cars. These CREDITORS get their money back first, usually by taking back their property. If this isn't enough to pay off the debt, the secured creditors get first dibs on cash.

Next in line, you have employees who have pending wages, up to 6 months before the bankruptcy filing. Depending on the state, there is a cap on how much they can receive, usually in the $12,000-$13,000 range.

Now here’s the catch, if there aren’t enough ASSETS, employees could walk home empty handed, or with only part of their compensation. Which sucks.

In the category of ‘likely won’t get paid at all’, you have unsecured debts. Those are the debts that aren’t backed by anything, like credit cards and bonds. These usually have high interests because of this very reason. Chances of getting paid here are slim.

In the very last category, you have Shareholders, and you know you are not getting a lot of money here. When a company declares bankruptcy, its stock becomes essentially worthless (This, by the way is one of the reasons why stocks are a riskier investment than bonds, one level down the ladder). Shareholders only get money after everyone else has been paid, which usually means zit.

Now a bit of the magic in all of this is that the buck generally stops here. The shareholders themselves don’t have to pitch in any of their money to pay for this stuff, which would also suck for them, and probably just for the economy.

Shareholders are not liable for any of the debts, and their credit score is not affected. That’s one of the reasons startups are Delaware C-Corps and not other corporate structures.

So, yeah, you don't ever want to declare bankruptcy and now you know it does come at a high cost. However, it doesn't always seem to be a death sentence for businesses, at least probably for the larger ones, the ones who can really remain lucrative maybe with better management.

And ultimately it's good that bankruptcy protection is there, to keep valuable companies from destroying economic value. Even in Monopoly, before losing the game, you can sell off your assets and maybe keep rolling the dice.

So, financial instruments like bankruptcy can even be seen as a way to encourage risk-taking and ultimately sustain an ever-growing, ever-changing, capitalist economy where not everybody can win.