Early Stage best funding options

To help entrepreneurs raise funds during these times, we just listed early-stage funding options for U.S. based startups. We're focusing on three programs this time; WeFunder, SeedInvest, and Republic. Throughout this article, we'll give you details on each platform, their sets of requirements, and any implications that the use of them might have for startup entrepreneurs.

We Funder

Here's a website focused on earlier-stage startup investment. As a sort of a KickStarter, its differentiator refers to their focus on startup funding. Through it, 40% of listed Regulation D companies, for example, have gone on to raise a Series A over $3M. Rappi, the now Colombian unicorn that's focused on delivery, for instance, is one of this platform's most successful examples of backed startups. It managed to record $339 million in follow-on funding.

How is WeFunder secured?

For security on your raised funds, WeFunder, as a public benefit corporation, is regulated by the U.S. Securities and Exchange Commission (SEC). The Financial Industry Regulatory Authority, Inc. (FINRA), a not-for-profit organization authorized by the government, also monitors this site. Its primary role is to oversee U.S. broker-dealers.

There's no secondary market on this platform. So, say you raise funding from 1K investors, they'll all still count as one shareholder on your cap table. They'll all fit under the name of XX Investments LLC.

There's also no voting on decisions. An approval on corporate actions only needs a signoff from a lead investor. And you'll be the one to have appointed that lead.

User culture on WeFunder

As for users, WeFunder's culture is quite blunt and transparent about how it works. They explicitly announce how much different from the New York Stock Exchange or NASDAQ they are.

User expectation, then, is more geared towards people becoming part of a startup community. People who vouch for your startup could thus easily expect perks. Some of those include store credit, discounts, or VIP treatment. In the end, users know they're going for an investment on which they can only either win big or lose it all.

Perks and expectations for founders

There are also several deals for founders who raise funds on this website. Part of your founder perks includes YCombinator application assistance, which is also probably why many companies on this portfolio go on to become YCombinator alumni.

Only be excited about the above if you're ready to go public on your financials, however. Doing so is required by law if you aim to raise funds on WeFunder.

Your first step to raising funds here is disclosing 2 years of financials in GAAP format. It takes about a week or 2 for an accountant to prepare that.

As part of your founder obligations, the platform also expects you to send an update to your investor list at least once per quarter. You're also especially motivated to share your company's annual report.

Market positioning

As a final point to WeFunder and, as per their website on their market position, they're "the largest funding portal by dollars raised, number of companies funded, number of investors, and most follow-on financing by venture capitalists." They also claim to have one of the best portfolios in their industry.

They'll take 7.5% of your total raise if successful. Yet, the platform will also match whatever better fee you can find that's lower than theirs.

SeedInvest Funding

We'll now introduce our next platform, SeedInvest. And we'll start by their reputation, as well, now that we're on topic. This platform is the second of our early-stage funding options for U.S. based startups. They claim to be the "largest equity crowdfunding platform in the U.S., representing 52% of the total U.S. equity crowdfunding market last year."

Now, while also aimed at early-stage funding, this platform is only open to companies that are raising capital through preferred equity or convertible notes. Common equity offerings are out, and preferred equity ones should be ready to present their pre-money valuation.

SeedInvest's placement fee is also 7.5% of what you raise. And their equity fee consists of 5.0%. They'll even throw in up to $3,000 of accounting fees in reimbursement once you launch a campaign.

Application requirements for SeedInvest

If you're considering an application, take note that each will need to include:

- Company name, location, and vision

- Terms and traction of the current funding round

- Terms and information on prior financings

- A pitch deck and other vital files presented to investors

Those raising on convertible notes will also need to give out the following to apply:

- Valuation cap

- Conversion discount

- Interest rate

- Term length

And, for your particular seed round, you should also be ready to define:

- Total round size

- The allocation you'd like to raise

- Amount committed from other investors

- Notable investors in the current round

Any offerings under Regulation CF will also need to comply with securities laws. To do so, the entirety of the offering needs to be available through SeedInvest.

Mandatory screening on SeedInvest

Prepare to get screened by a venture team. If that team deems your application of interest to SeedInvest, they then hand your request over to a screening committee.

As a heads up, the committee will check on your startup's value proposition, its proposed problem, and its corresponding solution. They'll also look at its competitive advantages, the team behind it, the size of your potential market, and your traction, of course. They might ask for clarification on any of these areas when needed. Any checks can include questions about your milestones, details on your fundraising, and a request for any supporting or backup documentation.

We can't stress how important it is to deliver top-notch material in the above areas. That's why we devoted a final section to this article on ways in which you can help your business thrive. Check below for more.

Republic Funding

As the third of our early-stage funding options for U.S. based startups, we included a platform that spun out of AngelList. Together with ProductHunt, these companies became part of a unique startup family.

Republic's platform average for 2019 was just over $500,000 raised. Yet, their success percentage of minimum funding goals refers to about 90% of campaigns.

Regulation CF campaigns require a Form C filing with the SEC. Typically, that comes at a $3-5k cost. Because of this requisite, you'll need to disclose your startup's financial history over the past 2 years. For that, you'll also need to include a balance sheet, an income statement, your cash flow, risk disclosures, and cap table structure. There's no need to add individual investor names, however.

Terms and requirements to raise funds on Republic

Republic, of course, comes with its own set of rules. According to those, the company and its management can never have been "found to commit fraud, securities violations, or serious crimes by any court or governmental agency." You also can't exceed $1 million in terms of the amount you wish to raise. That sum includes all other crowdfunding efforts in the prior 12-month period.

The commission for this platform is 6% of raised funds in cash. It also sets a 2% earning of the securities issued.

To wrap up on Republic, note they're holding live training sessions on how to raise funds on their platform. You can find those tools announced at the top of their website.

Prep the best version of your startup documents

To apply to these programs, we highly recommend you give a thorough look at your startup docs. From how to craft a perfect pitch deck to financial modeling done right, thoroughly check your material. Your traction slide, for example, needs to undergo some serious polishing. And you should also work hard on a successful business model. Of course, that applies to these programs and any business you make. But it's worth going the extra mile for any sort of seed funding efforts.

Get professional help if needed

We also offer writing, design, and modeling services for your pitch decks as part of Slidebean Consulting. A team of talented business analysts with expertise across multiple industries will work with you on condensing your information into a compelling pitch deck. That's perfect for your seed funding applications!

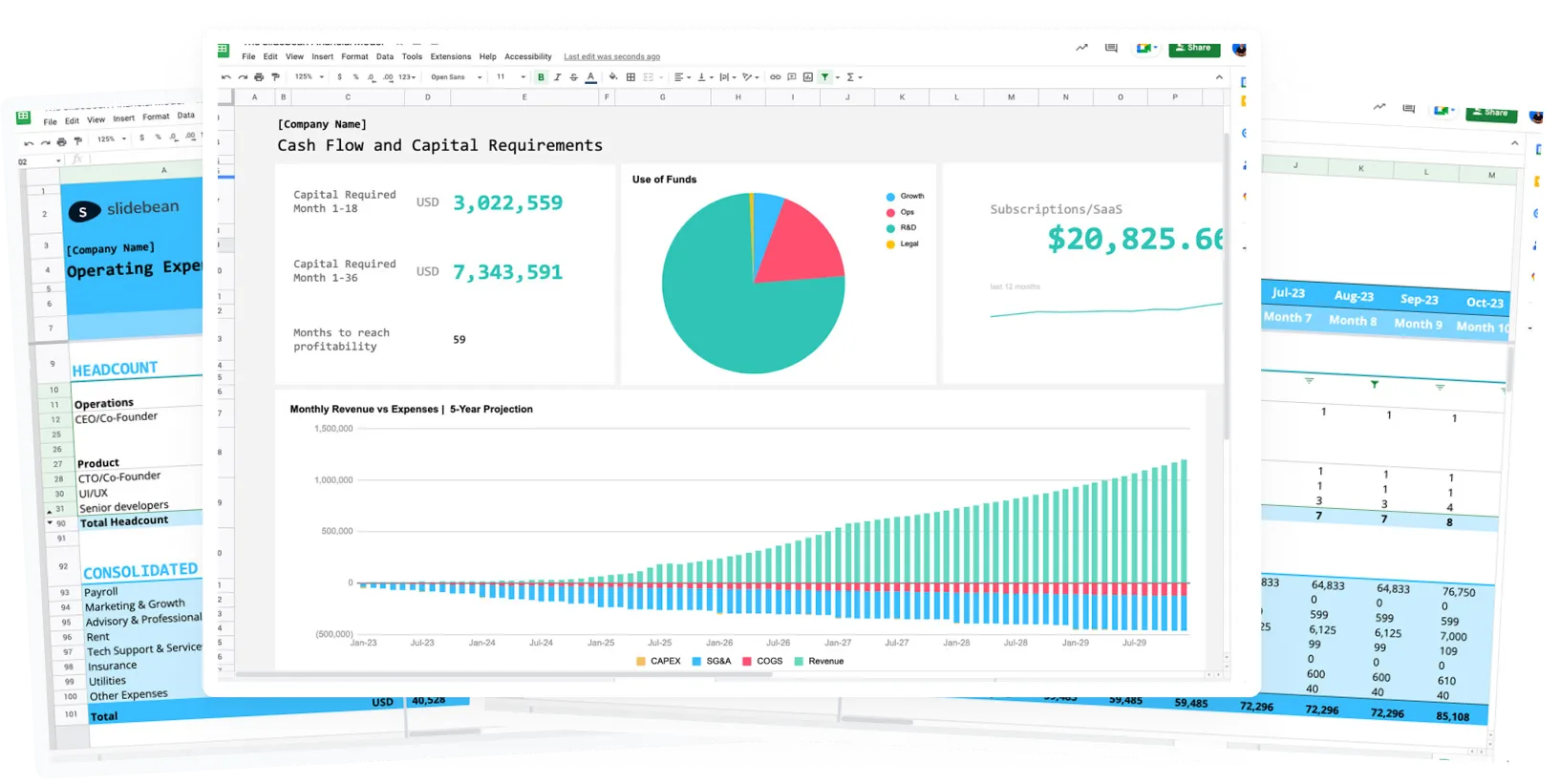

Coming up with a well-educated business model can be an incredibly complex task. That hard truth is why we focus on translating your financial data into a dynamic model.

We can certainly help you craft a reliable financial model for your business. It'll be one that predicts your company growth and burn-rate, as should be, based on past and present data.

And our pricing is accessible, primarily based on the driving startup results that you'll get. So, check out our options! You're also always free to contact us if you'd like to discuss more.