Investors who run into unfundable pitches rarely come back to say it. However, it is very easy to know with a few seconds’ view when a pitch deck truly reflects an unfundable business. We will highlight what makes unfundable pitch decks so you can stay away from making the same mistakes over and over again to no avail.

Of course, there are criteria to make pitch decks successful!

1. Bad market choices

An investor is very unlikely to fund a single project that does not focus on a good go-to market strategy. Regardless of your growth, traction, background, and any problem/solution combination you bring to the table, if the market in which you plan to do business is not big enough or just stale in growth, it will make no sense for an investor to spend any time or money trying to work a business opportunity out in that field.

Especially if the market you highlight is awfully competitive, one in which solutions are unlikely to make any real difference or matter to a targeted audience, any serious or experienced investor will know it is best to keep looking at business options in more fertile markets. It simply would make no sense to invest in given challenging market conditions.

2. A pitch without a real problem

Let’s face it; if you are not tackling a real problem, it is best to go home. Truly, a startup that is built on no real problem is bound to fail at raising funds. Yes, having options is great as a consumer, but it will not raise a lot of funding for the people who are thriving to make more than just a regular living off a startup. You should investigate how successful startup pitch decks have incorporated their problem slide.

If you cannot put into words or even keywords the exact relevant problem you are tackling, we have a big problem of a diverse nature. It would be one through which you will learn no investor is really serious about funding pitches with weak problem slides. The implications thereof are much, much bigger than just a need for a redesign.

Surely, there are markets out there where consumers could clearly have better options than the ones who are actually making it. However, you will then need solid traction to show how much of a living need you are feeding, and managing so, under those circumstances, is a bit rare. Rather, focus on a real problem about which people actually care; that is the main solution to defining an effective problem slide.

3. Offering a bland solution

Given your business is actually working to solve a real problem about which people actually care, then the solution slide should focus on solving that exact problem with a disrupting solution.

If there is nothing special, particular or peculiar about the solution you are offering, your pitch deck is at risk for being unfundable. Be great at what you offer as a solution, however, even be innovative and special and your cards will change to your benefit.

Make sure your solution is not just a bit better, either. As Peter Thiel put it, you need to be 10x better, not just 10 percent so. Thrive at ensuring you have the most unique and special solution to the problem you are tackling to stay away from being equally unfundable than a pitch deck without a real problem.

4. An “OK” growth is not okay

Do not fool yourself into thinking that “OK” growth is fine for a pitch deck as it might just cost you no single follow-up during your investment rounds. On the contrary, investors are looking for business opportunities in companies that can guarantee their growth.

Not standing out in terms of how well or quickly you are growing is a shadow to your business pitch deck. No traction means pure talk in the business world.

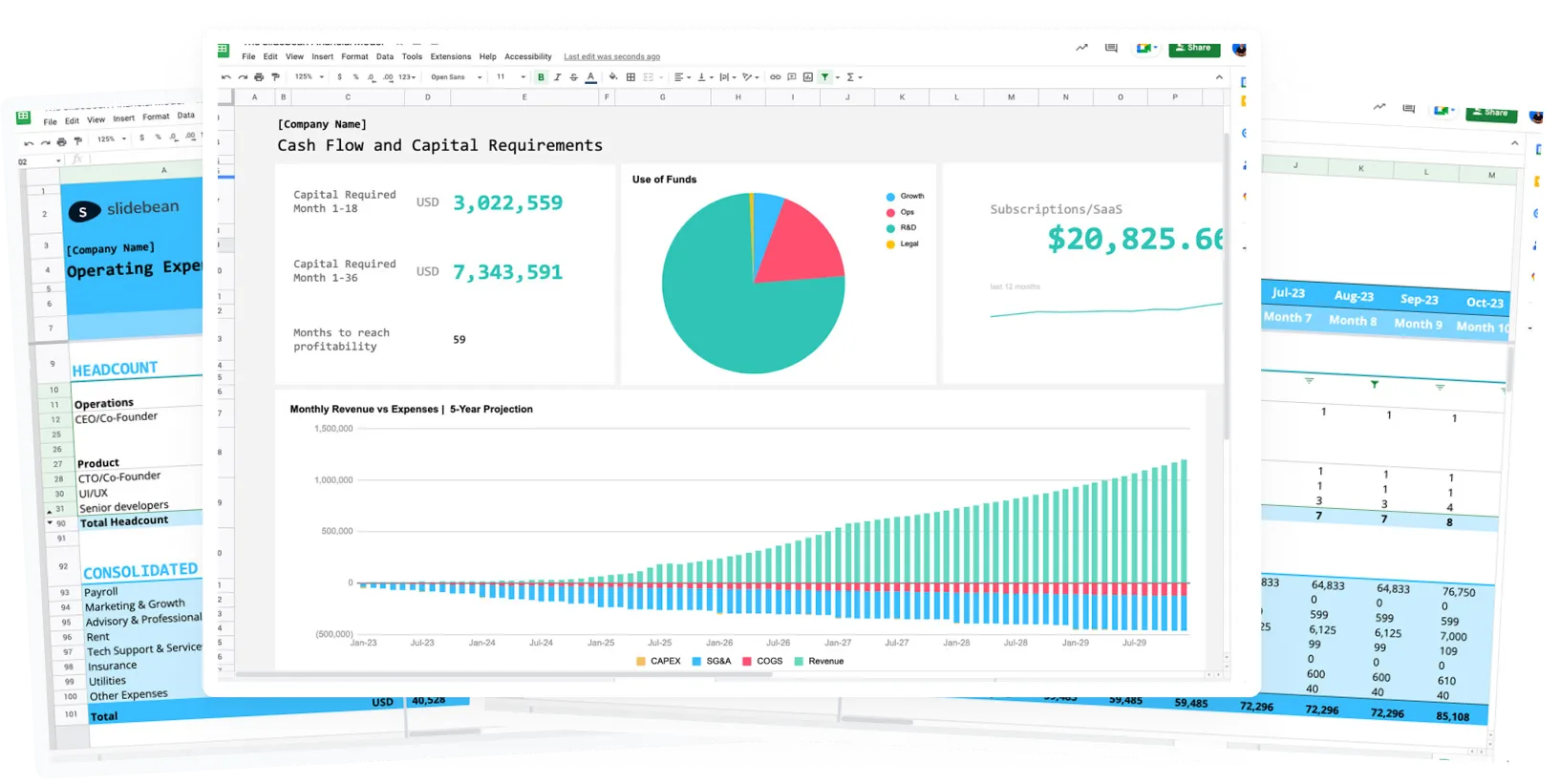

Scale and show how well you have been doing so even if you are not profitable. Growth is not about profitability, but about showing how you started off in one place and have managed to drive your company to great growth. Rely on metrics such as sign-ins or sign-ups, login length, downloads, or any kind of data whereby investors can actually see your business growth. Otherwise, a mild growth rate will be detrimental to your upcoming business presentation.

5. Poor metrics

Poor metrics get no one excited. And investors need to be inspired by the metrics you are displaying. Taking too long to reach new customers, to draw audiences in or to turn them into potentially revenue-making prospects can be indicative of more serious background failings. Therefore, make sure your metrics go from poor to attractive and excitable for your pitch deck to actually be anywhere near fundable.

Your metrics will define your business; these are the ones that will show how scalable your company is. While some can live on an OK rendition, the idea in funding businesses has to do with its growth and revenue-making potential. If you are okay with poor metrics, then funding is probably not what makes the best sense as a back-up to your business vision.

6. Have an “OK” team, as well?

You might get it, already; okay is just not good enough. Regardless of how well you get along, what great communication or past experiences you might have, or how did you find a co-founder, your team needs to be great, in order to excel through your pitch deck.

Perhaps you do not have ivy league formations on record or an extensive and provable record in terms of professional and business experience, and that is somehow okay. However, in that case, you need to make sure your company growth, your overall traction and other metrics along with your proposed solution truly shine through the roof.

Otherwise, you might, unfortunately, need to consider making changes to the people who are behind your business, trying to get it to scale. If you are not growing or creating the excelling trajectory that calls for funding, then the team behind it might need re-evaluation.

Ultimately, a great experience is relevant precisely because your team needs to be the ideal capable set of minds and bodies to make your business thrive. That is at the end of the day what investors care about in regards to your business to call if fundable, that you have the ability to make your efforts pay off (literally!) in ideal terms.

All in all, be prompt in stating your defensible business project with solid and factual back-up data so investors can start to feel like your business pitch is worth follow-up.