Cold emails are anything but that. While their name comes from a lack of a warm introduction, we can still make these communications so right that they generate the perfect way to start a great working relationship. How to pull that off, do you wonder?

We’re at the right place to discuss just that, especially thinking about investors. Our goal here in covering how to write a cold email to investors is to give business people, entrepreneurs, and business owners the best tips to succeed in startup objectives and, overall, in their careers! Join us as we go over the best 4 tips on how to write a cold email to investors.

1. Put yourself in their shoes

Empathy works like magic, yet, in the case of startup funding, especially bootstrapping, writing an effective email to a VC will depend on how well you can think like one. Before you send a VC an email, make sure you’ve considered a few background conditions.

As we mention, when we discuss how to do fundraising in 5 steps, “A big part of facing how to do fundraising has to do with extensive research.” While we tend to solely mean knowing all the relevant startup and market details that impact your pitch, this indeed starts by preparing in advance to appeal to angel investors. Caya, our CEO, described this well in How to Find Investors for a Business with just an MVP. In it, he states that “business angels [...] appreciate if you know their background, the projects they dealt with, the sphere they work in, their hobbies and tastes.”

All in all, anticipate questions and give out relevant details. Think ahead in everything you do when trying to cold email investors.

2. Consider the wording

Craft the email just right. The best cold email for a potential investor definitely has considerable thought behind it. Funnily enough, depending on your level of email writing experience, this can take a few minutes up to a few days or hours. Drafting a cold email correctly depends on your ability to develop the precise wording for the case you’re presenting.

On this note, consider your subject line extensively. Think of what you need to read when you get an email to be curious enough to even consider opening it, for example. Add a compelling and clear call to action to get what you need. Make an explicit request and work steadily towards improving your attachment open rate. We’ll go over links and attachments in more detail below, but here’s a related read on email marketing stats such as open and click rate averages.

3. KISS it!

Whatever you do, however, keep your cold email short. If you Keep It Short and Simple (KISS it!), chances are your cold email will do much better. For instance, and expanding on above, subject lines lower than 65 characters tend to work better than more extended versions. There’s tons of theory as to how to cut back on how you say a given need. And, if you’re looking to cold email potential venture capitalists, it just makes sense that your email doesn’t take up much of their inbox catch-up.

Shoot for an impressive introduction that gets your conversation rolling, not a lengthy description of what can be said over a phone call or live meeting. The goal here is to further discussions, not dump all your startup info at once.

4. Add the right kind of attachment

If you get an investor intrigued and confident in you enough to open an attachment, that better be a great one, wouldn’t you agree?

On the other hand, it’s certainly not the same result to have an investor or two browse through two total slides of your elevator pitch deck than having a high number of views of your full investor pitch deck. And knowing how your attachments are performing can make a considerable difference in various ways.

Fortunately, knowing this is easy. And it’s especially helpful for encouragement after you fish for funding for hours and invest hours of valuable startup funding work. You could end up with what would otherwise just be a discouragingly low margin of replies.

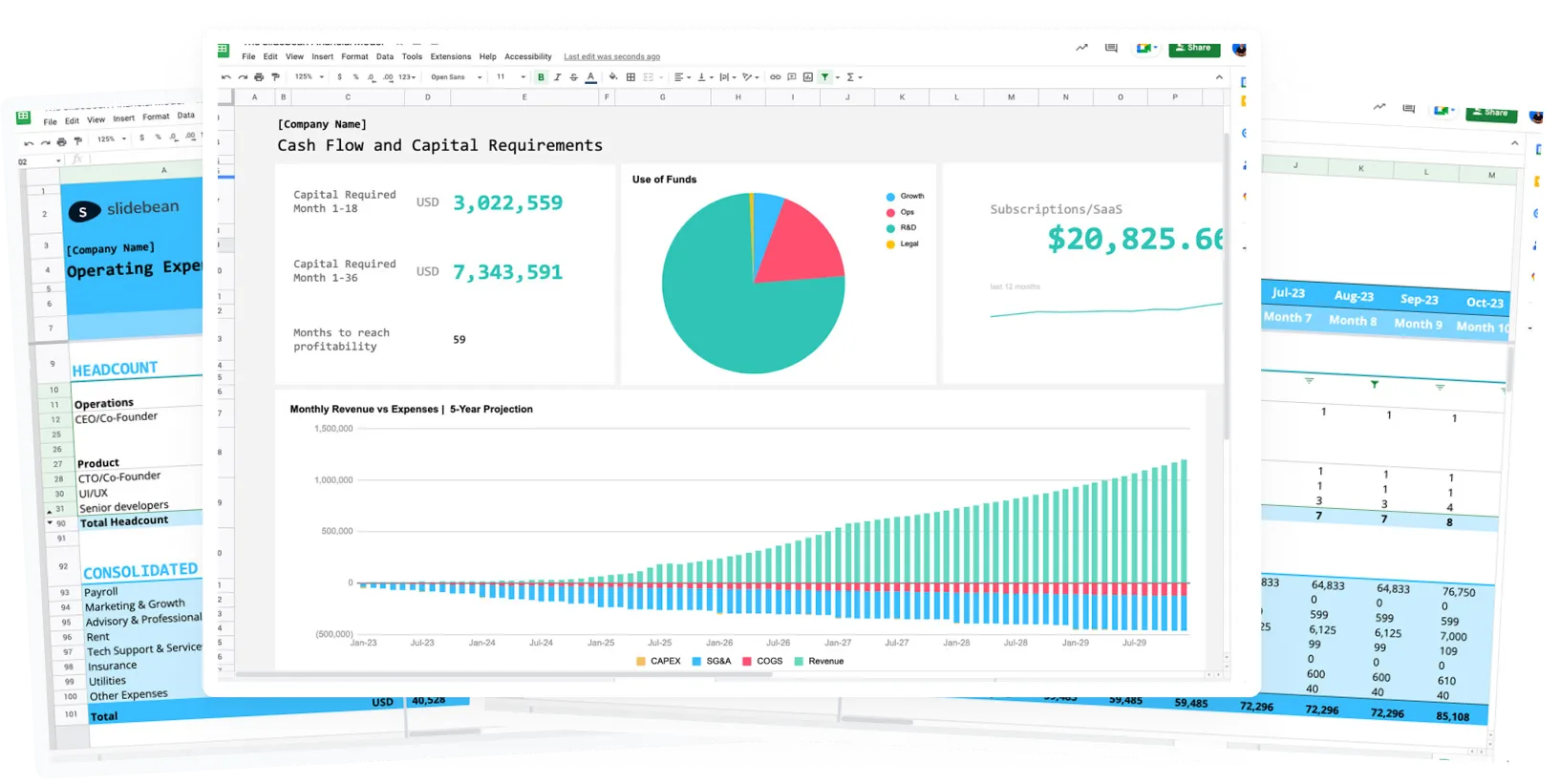

With our slide view tracking tool, you can first off see who’s viewed your slides. And two, you can also see how far they’ve gotten in that document review.

Also, remember you can use a tool such as Slidebean to share a link of your slides and track views that way.

Don’t just stick to email efforts

Defining investors’ interest areas and their working contact info is also crucial to finding a good startup match. Don’t just stick to your best efforts in writing emails and reaching out. To maximize results, make the best of investor finder tools as you work on email contacts, and rely on expert assistance if you can.

Clearly, if you’re looking to write cold emails to investors, a tool to find vetted VCs can be of considerable help for your business. In this sense, Slidebean’s most recent Investor Finder Tool can be the perfect solution for you.

Through it, you can securely and confidently tell us all about your business and the investment you’re seeking. And we’ll come up with a full list of vetted investor contacts within 48 hours. It’s a real seed fund lifesaver we’ve designed precisely based on our own startup experience.

With it, you get 5 investor contacts right off the start as a free sample. Yet, we’ll be aggregating and scrubbing 25,000+ angels, VCs, and investor profiles to find just the right investors and angels across all industries for you. On our paid version, we can list VC contact information and give you data on prior investments, as well. Our list also keeps growing every month!

Let our Investor Search Experts customize your contact efforts with key investors for your industry in no time!