Over the last few months, our advisors and our legal team have been working tirelessly to solve a terrible startup predicament that nobody plans for: growth. Slow growth.

And notice how, for any other company, 'growth' means success, but not for a venture-funded company: this is a fundamental concept you have to understand if you intend to pursue venture capital.

Let's draw a line between startup success and startup failure in the eyes of a venture capital investor, in the eyes of Silicon Valley.

On this side, we have failure. The company goes out of business. Slightly better is when the company's scraps get acqui-hired, which probably doesn't pay investors back, but at least it saves the tech and gives part of the team a job.

On this side, we have unicorn status: a startup gets funded, and within a few years, it reaches a billion-dollar valuation. Raising money is not the definition of success, mind you, but a billion-dollar company must be doing something right, for the most part (show WeWork and other failed unicorn startups).

In most cases, this means that the company has been able to scale revenue by around 300% YoY. That's not a typo; it's 3x annual growth.

To get to that Unicorn status, companies often raise multiple funding rounds: it's impossible to grow that fast without external capital. Those rounds are often called Seed, Series A, Series B, Series C, etc.

Now, the first round startups raise, is often structured as a convertible note. We have a full video about them if you want to understand the instrument a lot better.

In a nutshell, money is raised as convertible debt: the company commits to converting the investment into shares; but delays the decision until a new round of funding happens so that the convertible note investors follow the same terms as the new investors.

On paper, it sounds great, and convertible notes certainly have their advantages: they are a cheap instrument. You can close investors at different times and get money in your bank account faster than any other approach.

The problem is convertible notes (or bridge rounds as they are often called) are designed for these startup stories, and there are many stories in the middle where convertible notes can become a hassle.

Keep on reading and we'll tell you all about it.

The danger with convertible notes

So here are some of the rules defined in a convertible note:

- An amount, of course.

- A valuation cap: since the convertible note will transform into stock at a future valuation, defined by future investors, notes have a cap: a maximum valuation at which the money will convert. This is to protect investors in case company valuation skyrockets.

- An interest rate: again, since this money is debt, a standard 5% interest rate is often used.

- A maturity date: a maximum date at which the notes will execute. If a new round of funding isn't achieved, investors have the right to execute the notes, meaning, requesting a repayment, or converting them.

Again, the terms here are built on the premise of a future round of funding, that should happen if the company is growing fast.

If that happens, the process is simple: the notes convert using the terms defined by the new round of investors.

On the other hand, if the company is struggling, investors may force the founders to liquidate it and distribute the company assets, which probably wouldn't pay them back their entire investment, but at least it gives them something.

By the way, requesting repayments is often regarded as a douche move, and for the most part, investors avoid asking for them. It does give them a tool to pressure founders to look for an exit.

However, both of these options relate to the extremes in this diagram. But what about the middle scenario?

We could have a scenario around this area where the company is growing slowly and has managed to stay profitable. Maybe it generates a couple of million dollars in revenue per year and some profits. It's a business, after all, and nobody would want to kill it; but it's not a unicorn story, it's not going to grow 3x Year on year, and therefore it doesn't have access to more venture capital.

This scenario was us, Slidebean, in 2017, by the way, and I'll get back to this in a second.

In a better scenario, we could have a fast-growing company: say 30% to 50% or 100% year on year. It's found profitability, and therefore it hasn't seen the need to raise more money yet.

That's a successful company by most measures, but the convertible note terms don't really apply to it. It's not going to raise more capital: it doesn't need to.

Paying investors back is certainly a possibility; however, the business would need to get into profitability or cash cow mode to get that capital out quickly, which will inevitably cause the company to slow down. Perhaps another competitor could come in and take advantage.

So once again, neither of the convertible note alternatives seems to be a solution for this business. What to do?

I don't know the right answer to this question. I just know what we did.

The 2017 decision

Between 2015 and 2016, we closed around $800,000 in venture funding.

We used it to expand aggressively, expanded our team, our office, and our growth budget. And it kind of worked, but not well enough. Check out our video on that.

The point is, the runway was short, and we realized we were not going to get to the metrics we needed.

Founders choose one of two routes here: one is the full-speed-ahead round. Continue the aggresive spending while trying to raise more money to continue fueling it. They may get lucky and raise some bridge cash, but they might not. The problem with this approach, in my opinion, is that you depend on other people to keep the company running: you depend on other investments.

We took the profitability route. Painfully, we scaled down the budget, and that also meant our team, and got ourselves into profitability. We cut our monthly expenses from $110K/mo to around $70K, which was more or less the revenue we were making.

We survived! Sacrificed our growth and our potential for future funding, but we survived. What happened next was up to us and nobody else, well- except for the convertible note investors.

I went back to them, explained the situation, and offered them to extend the convertible notes' maturity date. We had a few ideas that would put us back on a unicorn growth path, and I asked them for time to try them out.

We extended the notes for two years, which delayed this conversion and allowed us to re-focus on the company: on very different terms this time.

The 2020 decision

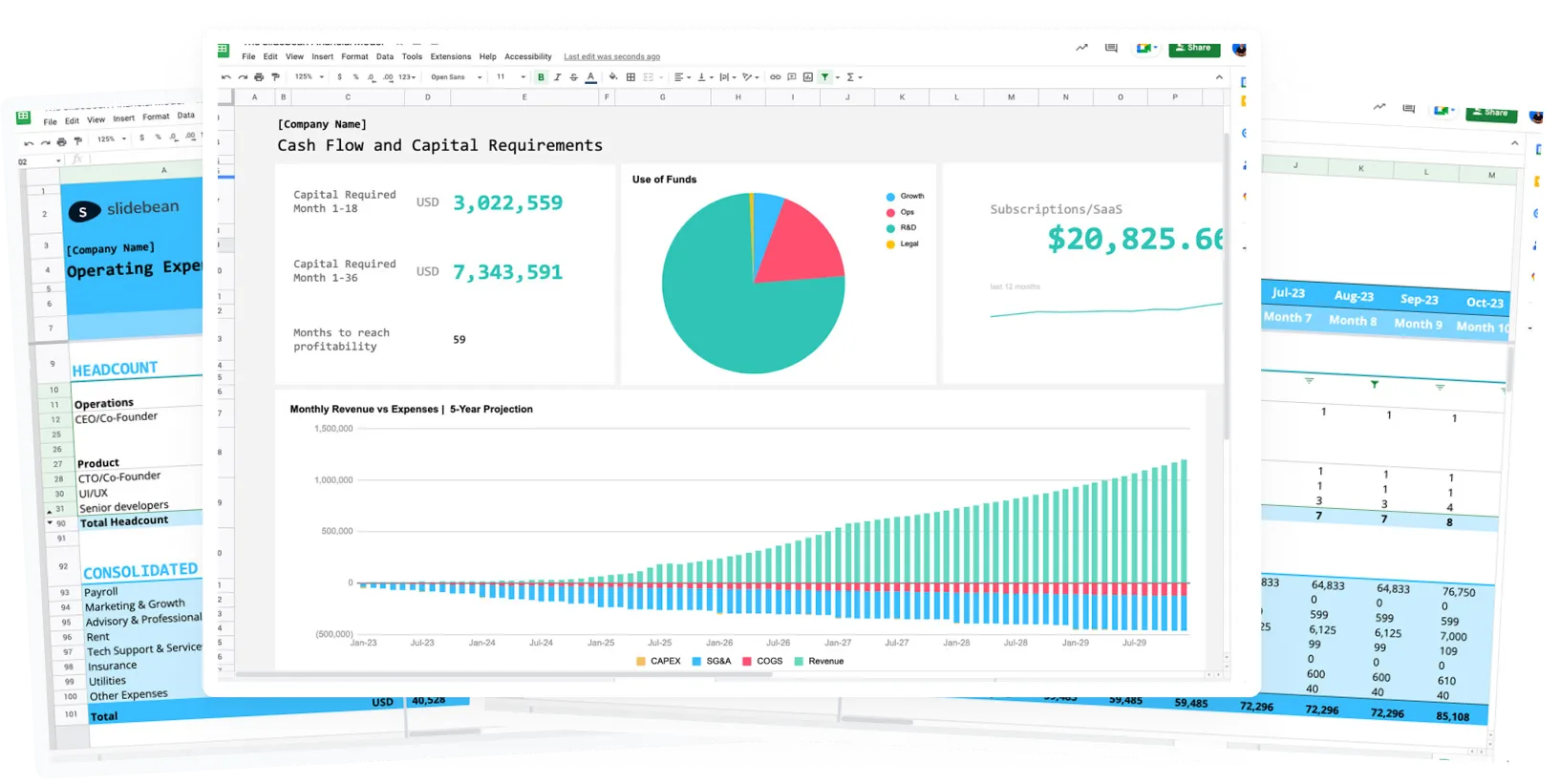

We did many things between 2017 and 2020, added artificial intelligence to our pitch deck builder, launched our consulting branch- Slidebean Agency, our Financial Model services, and began working on Monthly.

The fantastic advantage of running a profitable operation is that the company can choose to pursue these projects, these experiments, these new-startups without raising additional capital.

Some of these bets paid off: our Youtube channel for example

In 2020 the conversation was very different: we were growing faster, we had the ability to repay some of the notes without causing a financial struggle for the company. The valuation in the Cap was more justified now, because our revenue was a lot more.

So I came to our investors with a sincere pitch: I laid out the progress we had made while capital-constrained, our ideas for what Slidebean could become in the future, and asked them what they preferred. I offered to repay the convertible notes if they didn't believe in what the company could be come, and I offered the to convert them at the cap if they wanted to stay on board the ship.

The convertible note terms allowed each of them to pick, individually, what to do with their money. The vast majority of investors chose to convert, and the ones who didn't were bought out by some of the existing investors that were bullish on Slidebean. The rest of the money, the company paid back from our cash reserves.

This is, I believe, a fantastic outcome: we ended up with only the investors that wanted to stay, the company retained some of the stock that we didn't end up issuing while keeping a nice budget to continue investing in R&D.

But here's the problem with all of this: it's so far from the standard.

Nobody takes about what happens in the middle ground of a convertible note. Nobody tells you that not raising more venture capital is an option, and by many measures, we are not a startup unicorn success.

I still want the $100MM ARR business that we set out to create. I still think we can become that, but the path is not the straight line that you read in the press- and this alternative path is one that nobody wants to talk about.

Make sure that you prepare for it. If you raise money, by all means, use our pitch deck tools to do it, but remember that raising capital is just a means to an end. The end goal is to build a successful business, but success can come in many ways, not only with a Series F round or an IPO.