There's a lot to consider when starting a business, but the relationship with your co-founders is probably one of the most critical parts.

Starting a startup business checklist

I learned about early vesting and salaries the hard way. On the company I started in 2012 we did have a good vesting agreement in place, but failing to define salaries spiraled badly. I ended up with about $16,000 in credit card debt, which may not sound like a lot to you, depending on where you live... but 23-year old me, living in Costa Rica where the salary that I could aspire to was $12,000 a year- it looked like I was going to spend the rest of my twenties paying that back.

So today, we are looking into founder agreement when starting a business.

Now, let's start with stock and vesting. Once again, if you don't understand how stock works, you should check out this video.

Let's look at a simple and common scenario. Founder A comes up with a business idea for a tech startup. He has a business background and is a great hustler, but can't code. He seeks out Founder B, who has a tech background and has the experience to become the company CTO moving forward.

By tech company I mean an app, a SaaS, a hardware product, etc... an online store, for example, is not necessarily a tech company. If you're Founder A and you are starting an e-commerce platform, learn to use Shopify or Squarespace and build it yourself, at least until you start generating revenue.

So back to the original case, How many shares should Founder A get, vs. Founder B?

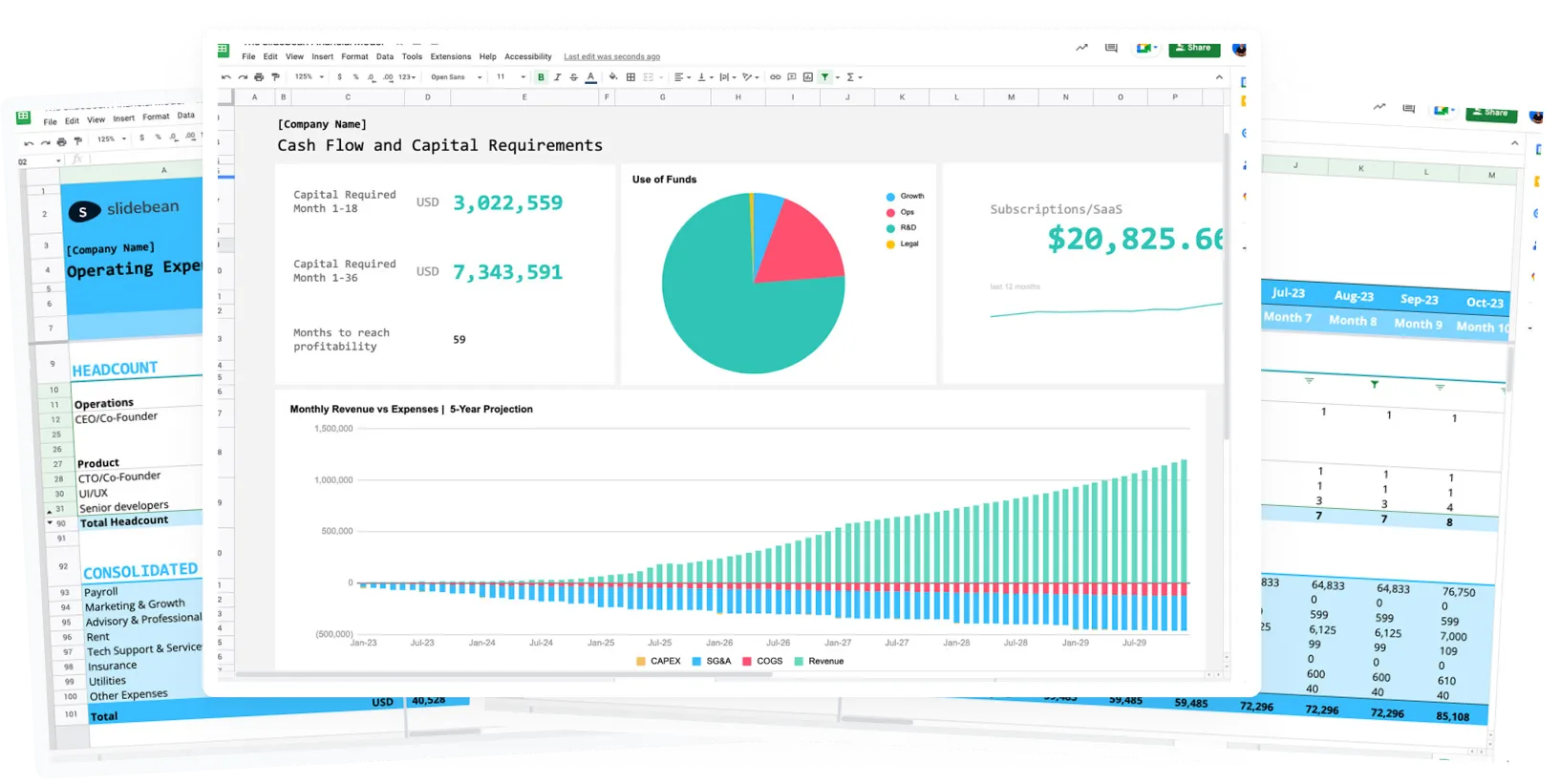

Try Slidebean

Probably a lot of debate here, but I am going to say in this situation this should be a 50/50 split. While Founder A has the idea, he can't execute it without Founder B. The idea, and the business are worthless without Founder B and being this a tech company, the product is just as important as the marketing, sales, fundraising, etc...

Now, this may be re-balanced if, for example, the business has some traction before Founder B comes in. And don't count 'talking to customers' as Traction: I'm talking revenue, sales, rounds of funding... users at least. That traction is worth something, so Founder A should be compensated for reaching that traction before Founder B came in.

The essence of this story is, whether there are 2 or 3 founders, the original company split should be equal- unless there is an additional value already provided by one of the founders, in the form of money or traction.

Now, let's say Founder A and Founder B agree on that 50/50 split, and six months later Founder B leaves. That would suck for Founder A who now has a missing-in-action partner who owns 50% of the company.

This is what Vesting is for. Founder Vesting is an agreement in the way stock is issued, while the founders are entirely dedicated to the business. We'll get back to the meaning of that.

A standard agreement is a 12-month cliff and 4-year vesting. This means that we'll take stock of each founder, say 500,000 shares, and split them in 48 months. That's about 10,416 shares per month.

For the first 12 months of working for the company, this stock will not vest: this is the cliff. That means if that person leaves, he won't take any stock in the company. The stock is a protection to the remaining co-founders in case that person leaves very very early.

On the 12th month, at the stroke of midnight, the vested shares for those 12 months will be executed, which means that founder will now on 125,000 shares of stock in the company, one-fourth of his take.

The remaining shares will continue to vest, monthly, thereafter. In case of that person leaving, the remaining founders are still protected and have additional stock for recruiting a new team member, and the person who is quitting is compensated for his work at a critical stage of the company.

Now, if you have a US business, it's really, really, really important that you file an 83(b) election if you are receiving vested stock. I can't stress this enough. If you forget, and your business grows or get funded, you might end up with thousands of dollars in taxes. You can find a free template for this on FounderHub.

OK, so we've established vesting. An additional challenge here is many businesses don't start with funding or money in the bank- so the founders still have day jobs or side projects to pay their bills. How do you establish, then what 'fully dedicated to the business' means?

It's tough. I'll lay out my example and hope that provides some guidance.

Once again, similar conditions are easier and ideal. If both founders have day jobs, then they can agree on a certain number of hours per day. The problem is when one of the founders has a day job, and the other one doesn't, or if one of the founders has a family to support and the other lives with his parents, or in a city where the cost of living is lower.

This is where salary agreements are useful. This is what I didn't do the first time, but learned a hard lesson and solved it for Slidebean.

When we started the company, we agreed that each founder would have a $1,000 salary. While our living situations and monthly expenses were different, we decided that was enough to live in San Jose.

So the priority was obviously taxes, legal fees and so on... but as long as the company had money after those necessary payments, everybody would get their full paycheck. If there weren't enough money, we'd get equal paychecks with whatever funds were left, and the company would 'owe' us that salary.

We self-funded the company for about a year, mostly with small consulting projects. We agreed that those were company projects, not individual projects... so even though the project only involved one or two of us, the money we made from that would be the company's money, and not that individual's.

This worked rather well for us, only a couple times we had to delay our payments- and we agreed that it was each one's responsibility to 'survive' until the next paycheck came in. Defining a limit here is also useful, maybe 3 or 6 months, after which the founders are allowed to take on day jobs without that being considered 'leaving the company,' for vesting purposes.

Defining that salary and where it stands in the company's cash flow priorities is critical, it's setting the rules of the game.

It's not pretty when companies run out of money, and there isn't enough money to pay stuff. That's a terrible time to agree on things. You should decide on things when things are moving forward, on good-will... and put it in writing. It doesn't have to be a lawyer-approved legal document, simply draft these rules in a document, print it, sign it and stand with your word.

Some other tips here:

- Come up with salaries that you can realistically afford as a company.

- If you live in different cities, you might agree on a salary adjustment for living costs.

- If one of the founders has savings or money flexibility and the other one doesn't, the solution is NOT to cut his paycheck but to use that money as an investment in the company. ¡

For example, let's say Founder A and Founder B both live in the same city, but one of them has savings, and the other one doesn't. A solution here would be for Founder B to collect a salary and Founder A to not obtain it, because 'he doesn't need it.'

That will create a mess afterward. Founder B has been receiving a salary and Founder A has been eating up his savings.

A good approach here would be for Founder A to invest $10,000 in the company and gets a fair stock compensation in exchange for that. Both get equal salaries since they both live in the same city.

This is my point when I say founder relationships are like marriage. You need to be open about this stuff and be prepared for new circumstances as the business progresses. I became a dad six months into starting the business... which could have been a mess unless these agreements had been in place.

So let me know what you think of those ideas. If you are open to sharing, leave a comment below with the logic on how you distributed founder shares so that others can learn.

A lot of you have come to us with amazing comments on the content we generate. We're glad it's useful!

If you like the content, share it and of course, give our AI-presentation platform a try. You can prepare business proposals or start working on your pitch deck; the exercise of making one can give you a notion of what you should be focusing on. Creating an account is free, and you can't beat free.