What is an Investor Pitch Deck?

An Investor deck is usually a 10-20 slide presentation designed to give a short summary of your company, your business plan and your startup vision.

What should be in a Investor deck?

Having a good grip at an investor pitch deck outline is a definite advantage in the way we deliver pitches during business funding rounds. For this article, we will not even make you read long. Catch our recap of what slides to include in your upcoming pitch deck for your business presentation next.

Slides to Include in an Investor Pitch Deck:

- Cover

- Problem

- Solution

- Product

- Market Size

- Business Model

- Competition

- Go-To-Market Plan

- Founding Team

- Traction

- Fundraising

Related article: Pitch Deck Examples

The Cover Slide to a Pitch Deck

Open up your business presentation with your name, position, your company logo and a tagline that gives insight on your business. Also, use big text here if you are presenting live.

Especially if you are emailing your deck, your contact information should be easily identifiable for your email contact to be able to reach you speedily should the need or desire arise to do so. In that case, some people like adding details at the end of the deck for ease of reference when emailing.

Furthermore, it is possible a strong social media base will help you out here. As investors will want background information on you (there should be no surprise there), a solid LinkedIn or company social media that shows high engagement might do the trick. It is not necessary to include this, but we leave it up to you for consideration.

What Is A Problem Slide?

And there is a reason why this slide is a serious opener for your investment round. With it, we aim to describe the kind of problem that exists in the industry in which we do business. All of it is done in expectation of how our product or service will be crucial in solving a pending need for a specific industry. Therefore, use your problem slide to describe what the specifics are to whatever constitutes the problem in your niche.

Investors need to be able to comprehend and moreover empathize, with the problem you are describing. Think about that and also consider how your problem is your point of departure for the rest of your presentation. Therefore, take some time to seriously outline what the problem is and do so in the most compelling ways. For that, you can always resort to storytelling.

For Every Problem, There’s A Solution

In the previous slide, we will have narrowed in on a particular trouble. Now is the time to shine by explaining how our product or service will be just the perfect solution (that is not currently out there or done fully well to any degree) for which investment is absolutely plausible - and profitable. We speak here of value proposition.

Now, remember! You will not be able to suit everyone however you solve the industry’s problem. Focus on your crowd, on those for whom your solution is not only viable but life-changing necessary. How your offer is better than existing ones is a crucial point of consideration here that should be quite simply clear.

So, What’s Your Product Like?

And here you can just pull a demo. Present it live if you can, or just embed a video that takes us through your product’s demo in a compelling way. Do you not have your product or service running full speed by the time you draft this slide? Use a prototype, if you have one. If you do not have a prototype, yet, then the best thing you can do is wait before you pitch your product to anyone; big or small.

Market Size on a Pitch Deck

This is a truly relevant slide for your investors, so make sure you cover a wide enough market into which it is worth putting any money. Choose between top-down data or bottom-up one. In the first case, you will be going off someone else’s numbers. In the second, it is a level of usage or other trackable data such as frequency of use or transaction sizes that will produce your figures for this slide.

Defining Your Main Business Model

Make sure you know what you are talking about here as it comes to revenue generation. Ideally, you will have narrowed down at least 1 to tops 3 ways, maximum, in which you plan to make your business very profitable.

Are you going by transaction, subscription or gross, for example? Is it direct, or indirect? Short-list if you have many sources, as it might make you come across as unsavvy. Thinking about a brand new business model? Risky, but possible. Stay away from great ingenuity here as with funding rounds, investors really need to know their funds will be managed in a way that actually brings results; not just some hip new testing that is very likely to fail.

Talk About Your Competition

Believing we have no competition is a hard one to justify. On the contrary, expand on your competitors, make it clear you know very well who they are and what they do. You have studied them by the time you get to this slide, and you have done that so well that it is unquestionable that your competition has been considered to no significant altering of your business vision. Contrary to thought, investors like being sure, safe and sound.

Know your competitors inside out, it only makes you a better insider in your industry than most, which can only be of a lot of use in making you profitable.

Go-To-Market Plan

Define how you will bring your product or service to the intended market. Who exactly will be your target audience and whatever plans you have for sales and as a marketing strategy should be laid out in this business presentation slide.

Highlight A Stellar Team

The idea behind your team slide is showing how well you are positioned with an excelling and the most ideal team behind your business. The mix and match you put together here between founders and awfully relevant and key players to your business are what the slide should highlight.

Showing Off Your Traction

If you are pitching in front of investors, this might just be one of your most important slides. Talking about your traction to date is a way of making your financial trajectory clear, or your business growth in revenue and profitability are still too big words for your company.

This slide should graphically outline just how much you have managed to grow since you started your company. It might not be a financial growth if you are expanding upon a number of users, logins, product use, and other factors, but certainly, aim at making it fully clear just how much your company has grown since you started via the traction slide.

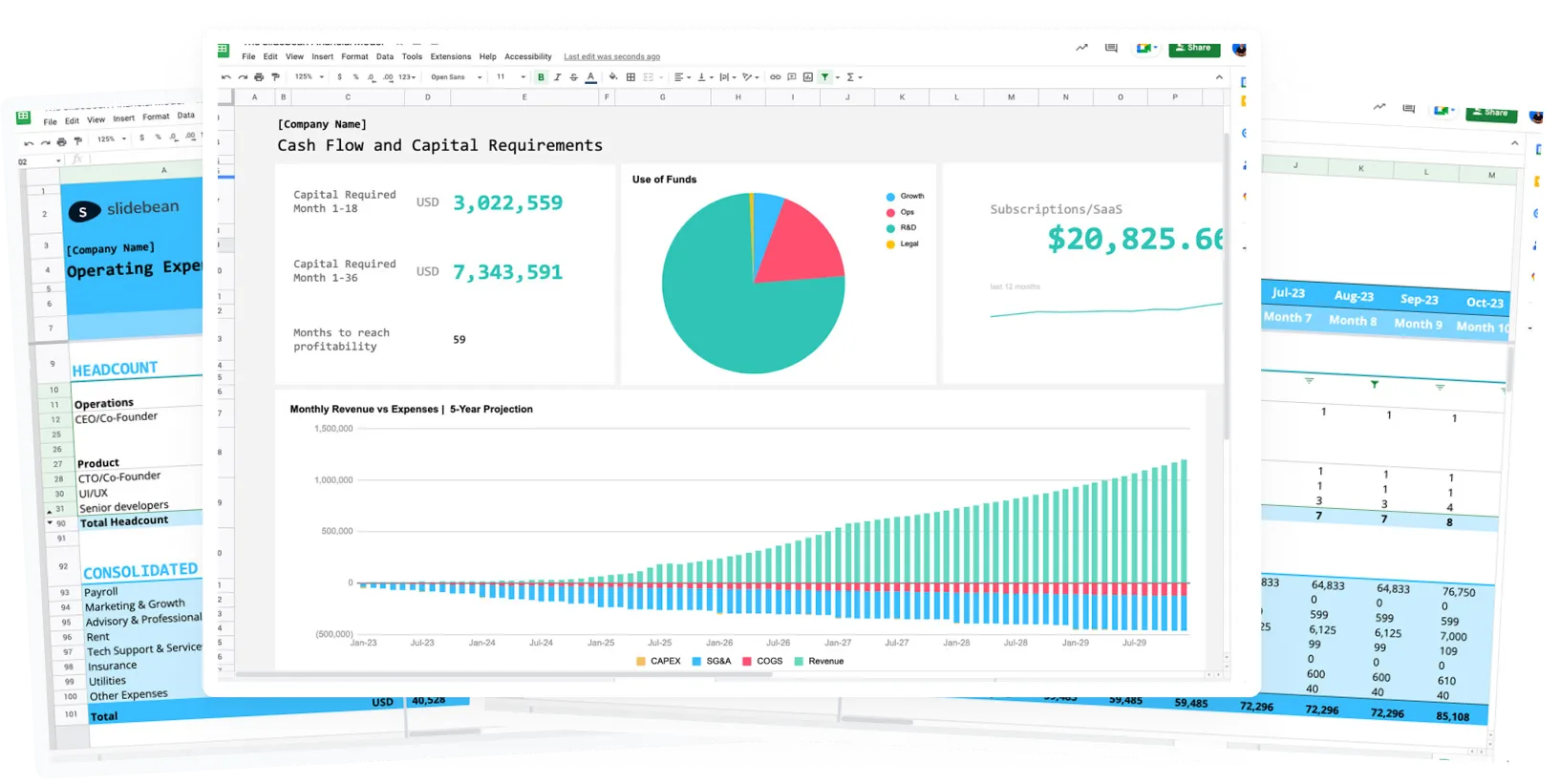

Defining What’s Next in Terms of Fundraising

As you are pitching to raise capital, this is where you define how much you are looking to raise and what use you will be giving those funds to accomplish what exactly. Your math needs to make sense here in terms of your next-level scaling. Investing in your company, or at least entertaining the thought of doing so, will be based on actual projections for your next milestones in this slide. It can all be discussed, questioned, changed...but the idea is to set a course as to your business vision in regards to your next funding milestone.

Investor Pitch Deck Templates

We hope this article has been of help! If you want to make your task easier, resort to our pitch deck templates for better ease at using the investor pitch deck structure and outline. Good luck with your business pitches!