On March 25th, 2020, the Division of Innovation and Industrial Partnerships (IIP) of the Engineering Directorate opened up the option for US-based small businesses (SB) to submit proposals. They’re asking for just the initial pitch to the first phase as a proposal for “the development and deployment of new technologies, products, processes, and services with the potential to positively impact the nation’s and world’s ability to respond to the COVID-19 crisis.” Here, we give you a summary of America’s seed fund for startups.

What’s this seed fund program?

The National Science Foundation (NSF) is the one behind this congressional mandate. It’s officially called the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Phase I.

Not exclusively, their potential areas for consideration are startups working with AI, digital health, diagnostics, environmental and pharmaceutical tech, as well as medical devices, disinfection, sterilization, filtration, and separations.

How many companies get funded?

Since 2012, the program has funded around 400 companies yearly. That makes for a total of nearly $190 million in awards per year. It also means approximately 3,000 awards to startups and small businesses to date. And they do so with businesses in nearly all tech and market sectors.

The NSF has made a searchable PDF of the full list of technology topic areas in case you want to take a look. You’ll find subtopic descriptions therein, as well, which can be useful to clarify any doubts or queries.

How the SBIR and STTR program works

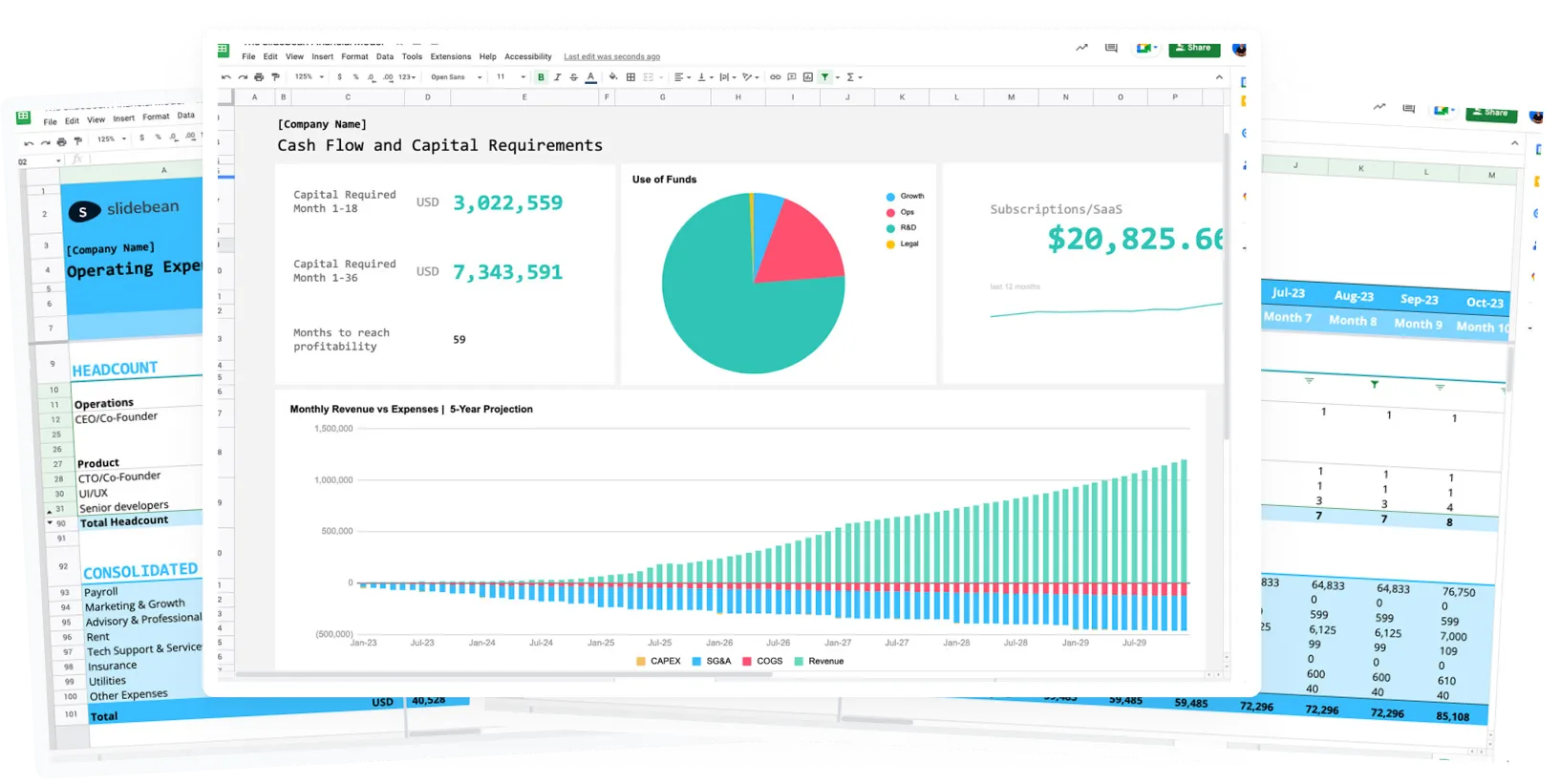

All in all, a company can get up to $1.75M in over 24+ months. The first phase starts with up to $256,000 in seed capital. And, through it, the funds are aimed at product Research and Development (R&D) over six to 12 months.

Once Phase I is finished, a company can request a Phase II investment of $1,000,000 over 24 months. And, in that stage, it’s also possible to ask for supplements, which may add up to another $500,000.

What do the funds cover?

Funding can go to pay for R&D costs like materials and supplies, as well as salaries and wages, which includes fringe benefits. However, the grant does not cover intellectual property, marketing, or business development.

What companies are desirable?

As part of this summary of America’s seed fund for startups, we’ll start by expanding on the program’s search profile based on the NSF’s timeline online.

- Transformative initiatives

Almost as part of every VC’s interest, as well, the program is currently looking for transformative initiatives that “could make a difference to people worldwide or revolutionize an industry.”

- High-risk investment

Contrary to being of concern, being a high-risk investment is actually part of the desired qualifications on this one. If you’re basing your product in tech that needs funding for further testing, for example, or if you just need to have more tests done, you can cross a big green checkmark over your eligibility list in this aspect.

On the contrary, it’s not a good program fit if you’re certain of your product’s technical feasibility.

- Proven market pull

You also need evidence to support your market pull. For that, you’ll need proof of a relevant and unmet need that you’re addressing for potential customers.

Who’s eligible?

- Small businesses (> 500 employees) in the United States

To qualify, your company needs to be a legal entity by the time you apply. And it must be organized as a for‐profit concern, acting as a Small Business Concern (SBC) as defined by SBA regulations at 13 CFR §§ 701-705. Non‐profit entities are thus not eligible, except as research institutions under the STTR Program.

- 50% of the company’s equity owned by US citizens or permanent residents

Also, applicant businesses can’t be owned in its majority by VC companies, hedge funds, or private-equity firms. Joint ventures and partnerships are, however, eligible, and, in the case of a joint venture, every party in it must meet all program eligibility requirements.

- The project’s principal investigator (PI) must be employed for at least 20 weekly hours.

Just a couple of heads-up here! One is that the PI doesn’t need to meet any advanced degree requirements. And two is that they’ll need to commit to a minimum of 173 hours (or 1 month) of work in the six months of the project’s duration.

If you’re going for this funding, we highly suggest you check the SBIR/STTR program’s 18-page eligibility guide.

A great pitch is mandatory

Before applying, you need to register on the SBIR/STTR Company

Registry and get an SBIR/STTR ID number.

To apply for the NSF’s program funding, you’ll need to start by submitting a project pitch. Yep! One of those in which we specialize with years of experience across different industries. It takes three weeks for you to hear back on it. We’ll expand on this area significantly further down this article.

It’s only after your pitch has been approved for a formal phase I proposal that you’ll need to submit a full work program for 6 and up to 12 months. As of the submission deadline, you’ll need to count 4 to 6 months to see if you were declined or admitted.

Say we get it, what’s next?

Expect to go deeper into your product-market fit, your tech’s feasibility, and doing considerable work on your design and its test prototypes. You’ll need to identify all legal and regulatory issues and come up with a plan on how to scale and market your technology. Sounds worth it, right?

The NSF program’s benefits

- Opportunity to scale

The clearest plus to all this, of course, is your ability to scale. The idea is for you to move from here to a profitable and market-impacting business. Just the NSF’s stamp of approval will later speak of your company’s influential tech and commercial ability. Yet, you also lose no equity!

- Losing no equity

The NSF takes no official or dividend part in your company, allowing small businesses to keep full control over their companies. Intellectual property is still your own; you get to keep your team as is, and you’re also the driver to the direction in which your work goes.

- A leading and knowledgeable network

Does this sound too good to be true? Well, you also have the added value of the network into which you’ll tap. Full of innovators and experts in their respective industries, being part of the NSF program’s cohort means working alongside other leaders in the industry; entrepreneurs and tech experts alike.

- A mentor and program directors

You’ll also come into direct contact with the program directors. This part typically includes being able to attend conferences and other kinds of events, as well.

- No location binding

If location is a concern for you, the program also offers virtual mentorship for companies in any US territory. You wouldn’t even need to relocate to be part of this funding and mentorship opportunity.

- Valuable feedback

And, if you don’t get chosen for this program, even your application can pay valuable assets. Every proposal gets run by a group of tech and commercial experts. Therefore, all applicants get detailed and actionable feedback for their startups. Even just applying can be a good source of valuable info for your company!

A brief background on the cohorts

336 companies are currently researching as per their phase I seed funding proposals. The list of active projects varies per technology topic areas. Among those, there’s above 40 companies with grants in 2 particular lines of business, biological and biomedical technologies.

On the other side of the spectrum, a Californian company, eSat Global, is the only one listed as looking into space technology in the current generation of grantees. Part of their abstract shows they’re currently looking to “transform 2-way, mobile satellite communications from a niche service to a broadly accessible mass-market product” as an example.

Project pitch guidelines

You only get 3 pages for your project pitch. In those, you’ll need to include 4 key elements. For the first two sections, you get up to 500 words. For the second 2, you get half that for 250 words each section total. Here they are:

1. Innovation

This part needs to be a description of your Phase I project focus. Briefly explain how your technical innovation started and why it meets the R&D aspect of the program as being unproven and of high-impact.

2. Objectives and challenges

Describe your R&D for Phase I, including how it meets the pure definition of R&D as opposed to engineering or incremental product development tasks. Outline how and why it is technically feasible or how it will reduce tech risk. You can also do both. Also, add why it’ll be commercially viable and impactful.

3. Your market opportunity

Go into customer profiling and pain points here as your company’s near-term commercial focus during the project.

4. Your Business and team

Give the background and current status of your business. Add key team members, filtering by those who’ll lead your tech and/or commercial endeavors.

Project pitch submission timelines

Each company can submit a single project pitch at a time. Yet, the program takes up to 2 project pitches per submission window. You just need to wait for an official reply before you re-submit.

There’s a current submission window open until June 4th, 2020. The next one goes from June 5th, 2020 to September 3rd, and the last one of the year from September 4th to December 3rd, 2020.

As we detailed at the start of this summary of America’s seed fund for startups, it takes up to three weeks for processing once you submit the pitch through an online form. You’ll also get feedback with the reply.

Submitting an outstanding project pitch

NSF staff are working virtually to check project pitches in all areas of technology. As this is the primordial step to applying for seed funding of up to $2 million, we highly recommend you invest the best of your time and resources into delivering the best version of your project pitch the first time around, especially so for a repeated submission.

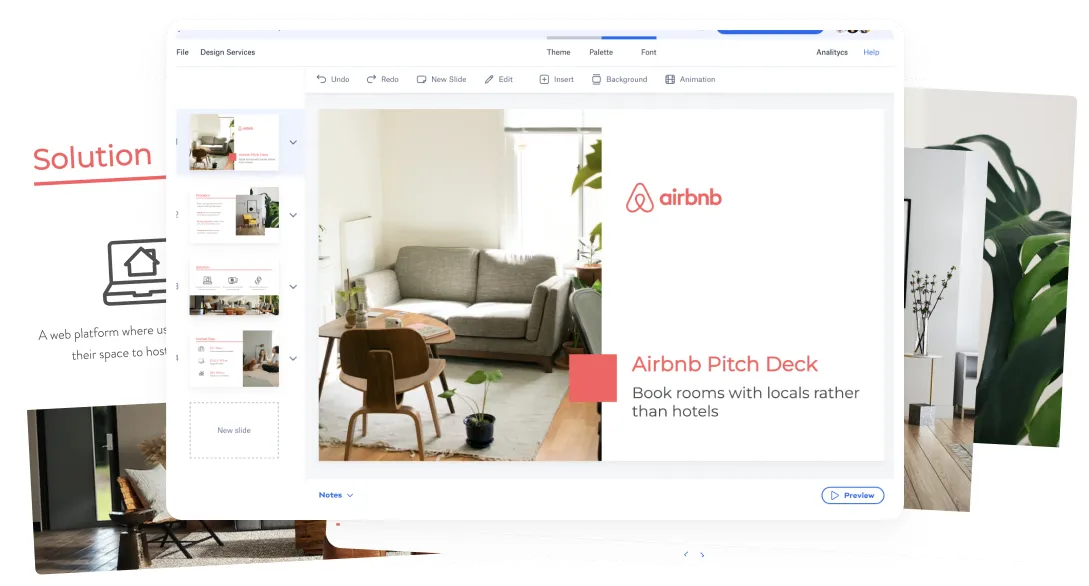

Luckily, with over 250 projects in the last 12 months alone and more than 25,000 pitch decks created with our help, all of our pitch deck consulting services start with a clear strategy defined in liaison with our CEO.

The process to a winning pitch deck

As an example of a process to a fundable pitch deck, we discuss the ideal angle for a business story before moving a pitch deck project over to our team of writers. Experienced business analysts across multiple industries then work under our CEO’s directive to condense business data into a winning pitch deck.

Our first draft commitment generally comes through in 3 business days, and revisions happen within the scope of 24 hours. We then have another briefing call with our clients before we have our design team take over.

We discuss the companies’ brand book and create a customized investor deck design that reflects their company identity with their established branding. They’d be getting slides within 3-4 business days as of then, and the business receives two rounds of revisions.

In case you were wondering, our pricing works on three different package offers.